Building a credible European market

Although Europe has experienced decades of economic integration, the continent still lacks a truly consolidated equity market. This discussion emphasizes the importance of establishing a unified platform that surpasses national boundaries and promotes capital growth for innovative companies. To explore both the opportunities and obstacles, we revisit the creation of EASDAQ in the 1990s—a European-focused initiative supported by local stakeholders and the NASDAQ in the United States. EASDAQ provides valuable lessons on the challenges of aligning cross-border policies, creating unified standards, and achieving collaborative governance within Europe’s financial framework.

In the coming years, transformative technologies like artificial intelligence and quantum computing will drive societal change at an unprecedented rate. The United States currently leads in AI development, supported by robust financial ecosystems such as NASDAQ. Central to this success is investor trust and the availability of cross-border trading mechanisms. For Europe to compete on a global scale, swift action is essential—particularly in forming a credible, standardized equity market that fosters innovation, attracts international investment, and positions Europe as a global leader in technology.

At present, most leading technology companies are publicly traded, primarily on NASDAQ. Europe has yet to develop an equivalent market, making it imperative for EU policymakers to prioritize this goal. Establishing such a market is essential to fund the digital economy, advance growth, and ensure Europe’s technological and economic independence. Elon Musk’s journey exemplifies the transformative role of public markets in supporting entrepreneurial success.

Elon Musk and the Influence of Public Equity Markets

Elon Musk’s remarkable achievements in technology and innovation stem not only from his entrepreneurial drive but also from his strategic use of public equity markets. From the founding of PayPal to Tesla’s groundbreaking fundraising activities, public markets have been a cornerstone of Musk’s success.

• PayPal: When eBay acquired PayPal for approximately $1.5 billion in 2002, eBay’s NASDAQ listing facilitated the acquisition. Musk, as PayPal’s largest shareholder, used part of his gains to fund future ventures.

• Tesla: Listed on NASDAQ since 2010, Tesla has attracted billions in worldwide investment, enabling its technological and manufacturing growth. The company’s use of equity and convertible debt offerings transformed it into one of the world’s most valuable automakers.

• SpaceX: While still privately held, SpaceX has indirectly benefited from Musk’s liquidity through Tesla shares. By selling Tesla stock, Musk financed SpaceX’s pioneering rocket projects and his acquisition of Twitter (now X) in 2022.

A credible exchange like NASDAQ allowed Musk to scale his innovations, whether by expanding Tesla’s global reach or advancing SpaceX’s interplanetary ambitions. His story highlights the critical role of dynamic equity markets in enabling transformational innovation.

The Strength of NASDAQ’s Unified Market

NASDAQ’s strength lies in its transparent regulatory framework, overseen by the SEC, which ensures consistency and investor protection. Its global investor base guarantees strong liquidity and fair pricing. By adhering to U.S. GAAP and maintaining a single set of listing standards, NASDAQ lowers entry barriers for international participants. This unified approach fosters trust and stability, making it a model for global equity markets.

The Challenges of Fragmented Markets in Europe

Europe’s financial markets are currently fragmented, with 35 listing exchanges and 18 clearing houses compared to the U.S.’s three exchanges and one clearing house. This fragmentation reduces investor confidence and complicates cross-border trading. Specialized segments for technology companies often feature lighter regulation, but they lack the robustness of fully regulated markets like NASDAQ, leaving Europe at a competitive disadvantage.

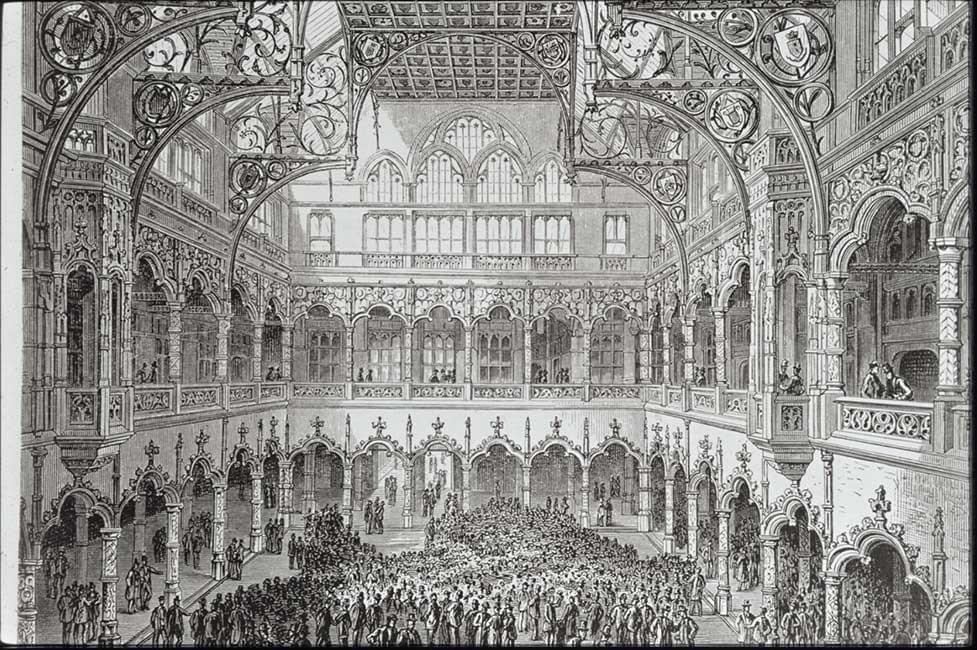

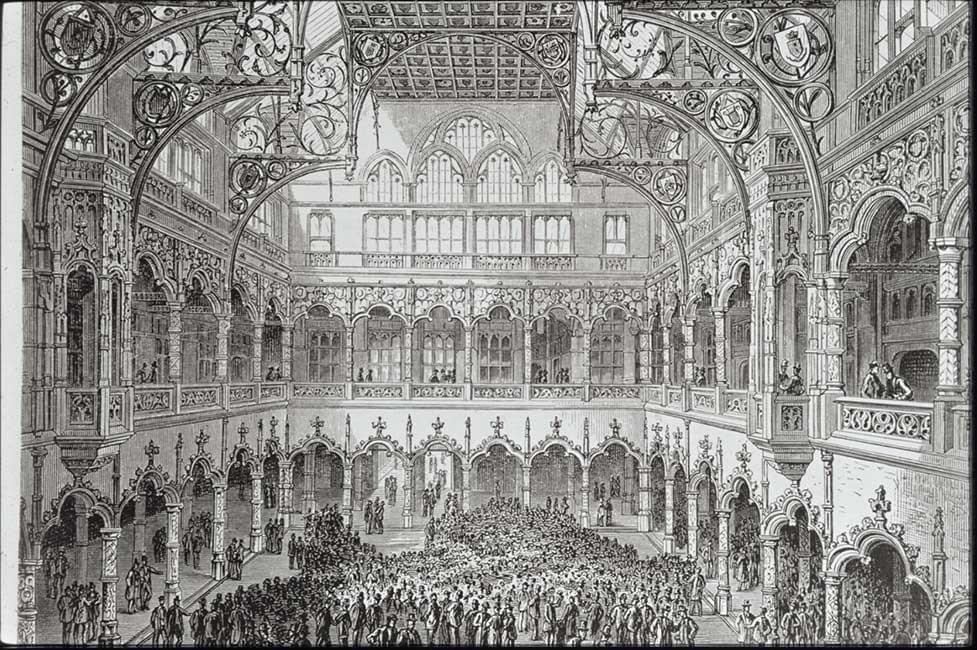

EASDAQ: A Case Study

Launched in the 1990s by the European Venture Capital Association, EASDAQ sought to create a European equivalent to NASDAQ. Despite Europe’s fragmented markets at the time, EASDAQ laid the groundwork for cross-border trading with a unified English-language prospectus and standardized regulations. While structural and political barriers ultimately hindered its success, EASDAQ underscored the importance of harmonized standards and collaborative efforts in building a cohesive capital market.

Euronext Growth vs. NASDAQ Capital Market

Euronext Growth and NASDAQ Capital Market both support growth-stage companies, but NASDAQ offers greater global reach and regulatory rigor. While Euronext Growth operates under a lighter framework, its classification as an MTF limits its appeal compared to NASDAQ’s fully regulated environment, which inspires greater investor confidence.

In conclusion, Europe must prioritize the creation of an integrated equity market akin to NASDAQ to remain competitive in the global digital economy. Musk’s success exemplifies the transformative power of robust public markets in driving innovation and economic growth.

Jacques Putzeys

September2025

©2025 - Proudly built with Strikingly